Cost cube

From ControllingWiki

IGC-DEFINITION (abbreviated)

Cost cube

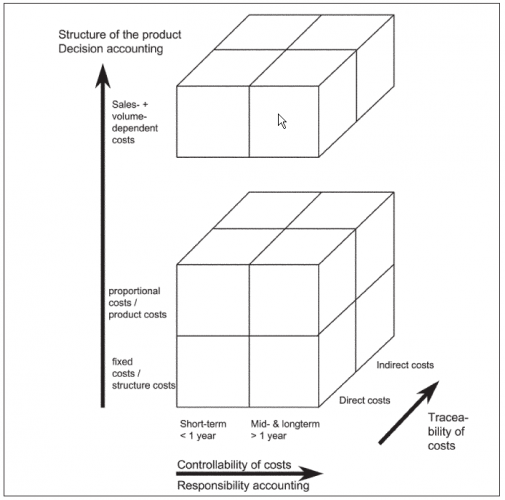

If we want to analyse the management’s responsibility for costs and revenues and prepare the necessary information for taking cost-related decisions, we first must present the different cost aspects in the clearest possible way, showing how they are inter-linked, and second make consistent use of clearly defined concepts. The cost cube is not a new theory but rather a model for explaining cost behaviour, which has proven itself very useful in practice. It presents the cost aspects in three dimensions:

- Product costs / structure costs (vertical axis of the cube):

For the purposes of decision accounting it is important to differentiate between costs caused by the nature of the products on one hand – and costs caused by the structure of the business on the other hand. Product costs (proportional costs) are the direct and causal consequence of producing a product-item or a service.

In contrast structure costs are defined by a business’s capacity and organisational structure. These are costs, in other words, that are not directly dependent on output but are determined by decisions over the business’s capability to produce goods and services. These structure costs express the necessary effort to ensure that goods and services can be produced at all.

- Controllability in the short or middle term (horizontal axis of the cube):

“Who has the competence to influence costs as they arise and in what time-frame can the costs be changed?” These are the questions asked by responsibility accounting. This dimension shows, which cost amounts can be altered in what time-frame.

- Direct and indirect costs (third dimension in the cube):

Whether it is a matter of direct or indirect costs depends on the object in question. The salary of the employee in the accounts receivable department (structure costs, controllable in the middle term) belongs to the direct costs of the accounting cost center, but to the indirect overhead costs of products. Material costs for highly refined parts (product costs, controllable in the long term, because only one supplier is available) are direct costs of the manufactured product.

The same three-dimensional way of thinking applies to the costs dependent on revenue. Commissions, deductions from revenue, freight charges, those parts of the distribution costs dependent on orders etc. – All these costs are no longer depend on the volume produced but on sales-mix, sales volume and revenue, which means they need to be represented by a detached cube.

from: IGC-Controller-Wörterbuch, International Group of Controlling (Hrsg.)